Ideally care would be free regardless of individual needs or financial background. Unfortunately, in reality things are a little less straightforward, with funding based on individual circumstances.

The full cost of your care home place can be met by contributions from different sources. If your local council has agreed that you need to move into a care home, it may pay part or all of your fees, depending on how much income you get and what savings you have. It will work out how much you should contribute.

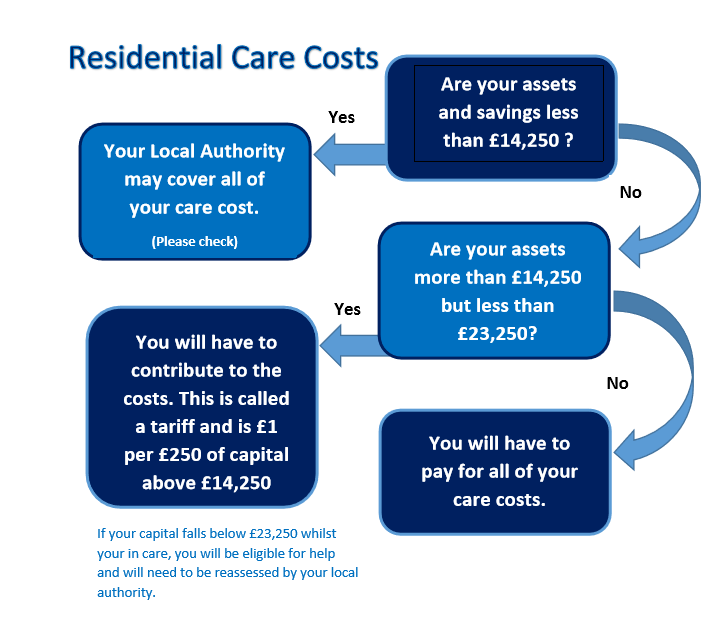

The financial aspect of moving into a care home can seem complicated, but there are rules for working out how much you will pay. We have outlined the basic rules for you below:

If you’ve been assessed as needing to move into a care home, your local council will work out how much you should pay towards the cost.

This depends on your income and savings. There is a fixed upper limit to the amount of savings you can have and still get local council funding. For example, if you have £25,000 savings, you will have to pay the full cost of your care.

There is also a lower limit – any savings you have below this cannot not be counted. For example, if you have £8,000 in savings, this should be completely ignored when your local council is working out how much you should pay.

The savings limits usually go up every April. The rates here are for 2018-19:

Upper limit – England £23,250 – Lower limit – England £14,250

If you have more than the upper limit in savings you will have to pay the full fees for your care home.

If you own your home, its value will be disregarded for the first twelve weeks you are in care as a permanent resident. After that, the value of your home will usually be counted as capital. This usually means that you will be expected to sell it to pay the fees.

But your house will not count as capital if it is occupied by:

- Your husband, wife or civil partner (or unmarried partner)

- If a close relative over the age of 60, or a relative under the age of 60 who is incapacitated

- Your estranged or divorced partner and he or she is a lone parent with a dependent child

- A child under 16 you are liable to maintain and your house is the child’s main home. The child must be either a relative of yours or a relative of a member of your family

The local council may also ignore the value of the house if it is the permanent home of someone else, such as a carer; it doesn’t have to do this, but it can choose to.

If your house is counted as capital, but you don’t wish to sell it, the local council can allow you to defer payment of your contribution. It will effectively be giving you an interest-free loan to be paid back when your property is eventually sold. You can get advice about this from SeniorLine on 0808 808 7575.

f you have less than the upper limit in savings, or when your savings drop to this level, then you must contact you local authority to inform them of your circumstances and to let them know you will require help.

They will need information from you about your income and what savings you do have will be taken into account to work out how much you will pay towards the home fees.

When deciding how much you have to pay towards the fees, the local council must always leave you with some money to spend as you wish each week. This is called a personal expenses allowance. In 2018-19 this is set at £24.40; this rate goes up every April. Most income you have over this level will go to the local council to cover your care costs, up to the full amount of the fees.

Your income is worked out by calculating what money you have coming in each week. This includes the income from your savings, any pension you receive (state, occupational or personal), and any income from benefits, such as Pension Credit.

Any savings you have below the lower limit are ignored altogether. Savings of between the lower and upper limits are converted into a weekly income using a simple formula.

The local council should tell you how it has worked out how much you will pay. Ask for this information in writing.

Make sure you understand exactly what is included in the fees and what you will have to pay for yourself. For example, will you have to use your personal expenses allowance to pay for toiletries, phone calls, outings or clothing? Or are any of these things included in the fees? The residential home I’m interested in costs £500 a week, but my Local Authority says it’s too expensive. Can I still move there?

The Local Authority will determine the amount they will contribute towards your care. So if they believe that a home charging £460 a week would suit your needs, they probably won’t pay any more. You will need to make up the difference. This is called a “3rd party top-up”.

It is illegal to give away property or savings to another person in order to qualify for financial help from your local council. This is called deprivation of assets. If the local council believes that you have deliberately given away assets to reduce or avoid care home fees it may try to claim the fees back.

It is important to remember that if you give away your home, you may lose control over what happens to it. Although you may feel protected if you give it to your children or other relatives, you may have no legal rights if things change.

If your local council is funding all or part of your fees, it is responsible for paying the fees directly to the home. If you are contributing part of the fees, you will have to refund this amount to your local council.

If the local council decides you can pay the full fees, it will probably expect you to arrange your own care home place. If you’re not able to manage this, or don’t have someone who can help you, the local council must arrange a place for you.

Paying for care is complex, and everyone’s situation is different. You should seek advice about your own situation and here are some organisations that offer specialist help:

- Age Concern 0808 808 6060

- Help the Aged 0808 800 6565

- Counsel and Care 0845 300 7585

- Your local Social Services Department the Department for Work Pensions 0800 99 1234

- Independant Financial Advisors (ring 0117 971 1177 for the names of local IFAs)

LAKEVIEW BROCHURE

“Finding the right type of care doesn’t have to be difficult , you are not alone we can help you”

Click the links below to find out all the information you require about our quality residential care homes.